HOW IT WORKS

This strategy uniquely blends the benefits of leverage with the cash accumulation features of index universal life (IUL) insurance. It enhances your potential for policy distributions, such as policy loans, to supplement your income while also providing protection for you and your family.

ACHIEVING GROWTH

The growth potential of your IUL insurance policy is linked to market indices such as the S&P 500 or MSCI

The point-to-point strategy offers growth potential based on a selected index, such as the S&P 500,

over a defined period (e.g., January 2022 to January 2023).

If the index shows positive performance at the end of the period, your IUL insurance policy is credited

with a portion of that growth, according to the current interest rate caps and participation rates of the policy.

The annual interest credited to the IUL insurance policy is locked in each year,

protecting any gains from future market declines.

IUL insurance policy minimum interest rates and interest rate caps vary by carrier and by state.

A STRATEGY THAT IS TESTED AND STRESSED

While the future is uncertain, examining historical trends reveals common patterns.

This strategy leverages these patterns to help you plan for the unknown.

By stress testing your designs through some of the toughest economic conditions to date,

we implement a strategy that helps protect against potential future economic hardships,

enhancing your chances for a more successful outcome.

GREAT DEPRESSION SCENARIO

1980’s HIGH INTEREST RATE SCENARIO

Normal Market Conditions

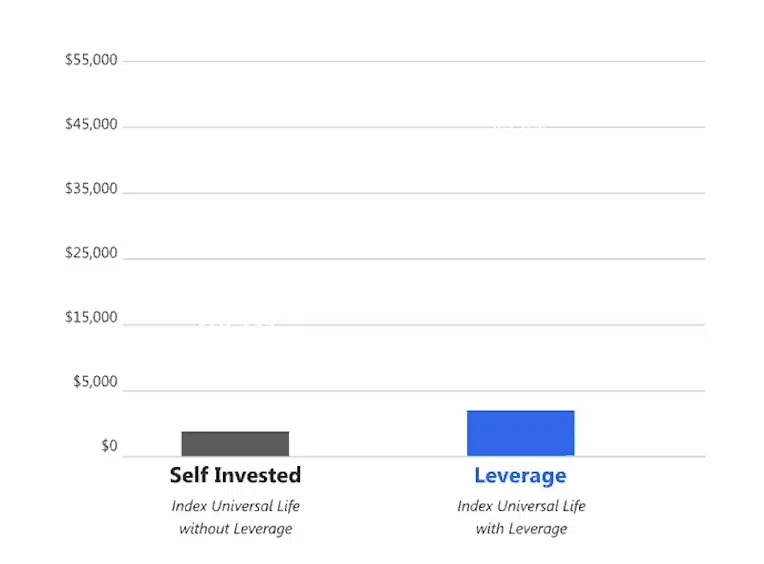

This simulation illustrates the potential distributions you could receive in retirement by using financing to fund your life insurance policy, based on the current illustrated returns from insurance companies.

1980s Interest Rates

This simulation shows the potential distributions you could have received in retirement if you used financing to fund your life insurance policy during the highest borrowing rates in U.S. history (1980-1995).

Great Depression Returns

This simulation demonstrates the potential distributions you could have received in retirement if you used financing to fund your policy during the worst market correction in U.S. history (The Great Depression, 1930-1945).

Leverage For Retirement

NIW and KaiZen is a registered trademark of the NIW Corp of Texas and Ray Alkalai is an authorized representative.