ADD UP TO 3X MORE CAPITAL TO FUND YOUR FUTURE.

Watch the video below to learn more about the potential benefits leverage can provide you!

THE PROBLEM

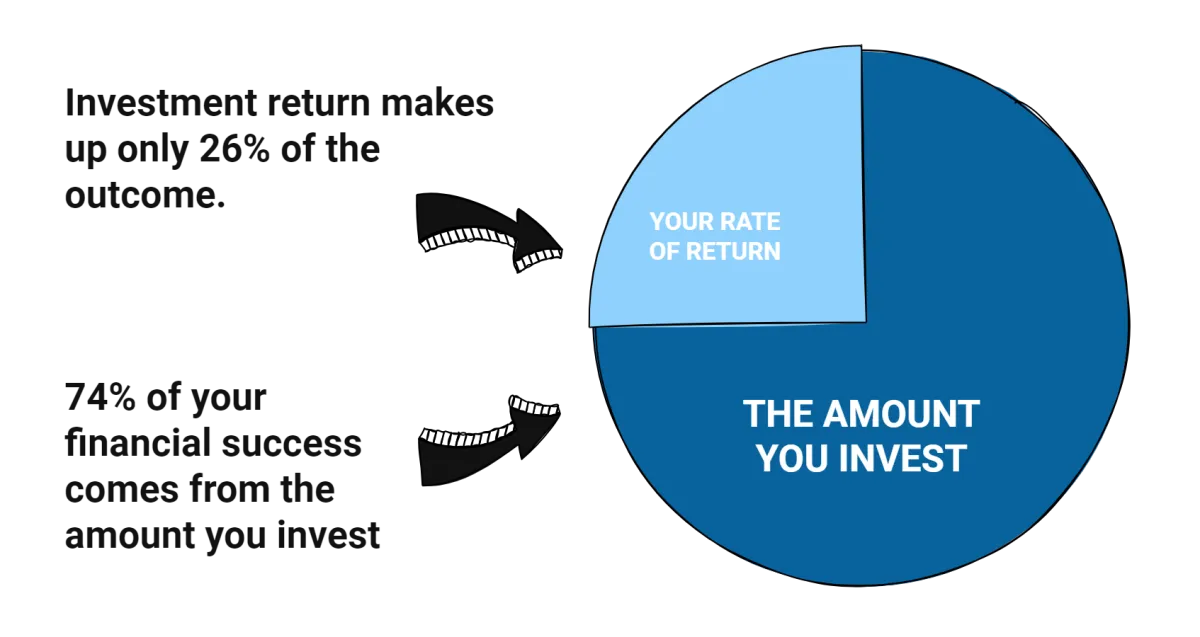

Your retirement success hinges more on how much you save rather than the rate of return on your investments.

On average, Americans have saved only 78% of the funds necessary for a comfortable retirement.

- Fidelity Investments

IN FACT

THE SOLUTION IS

Leverage

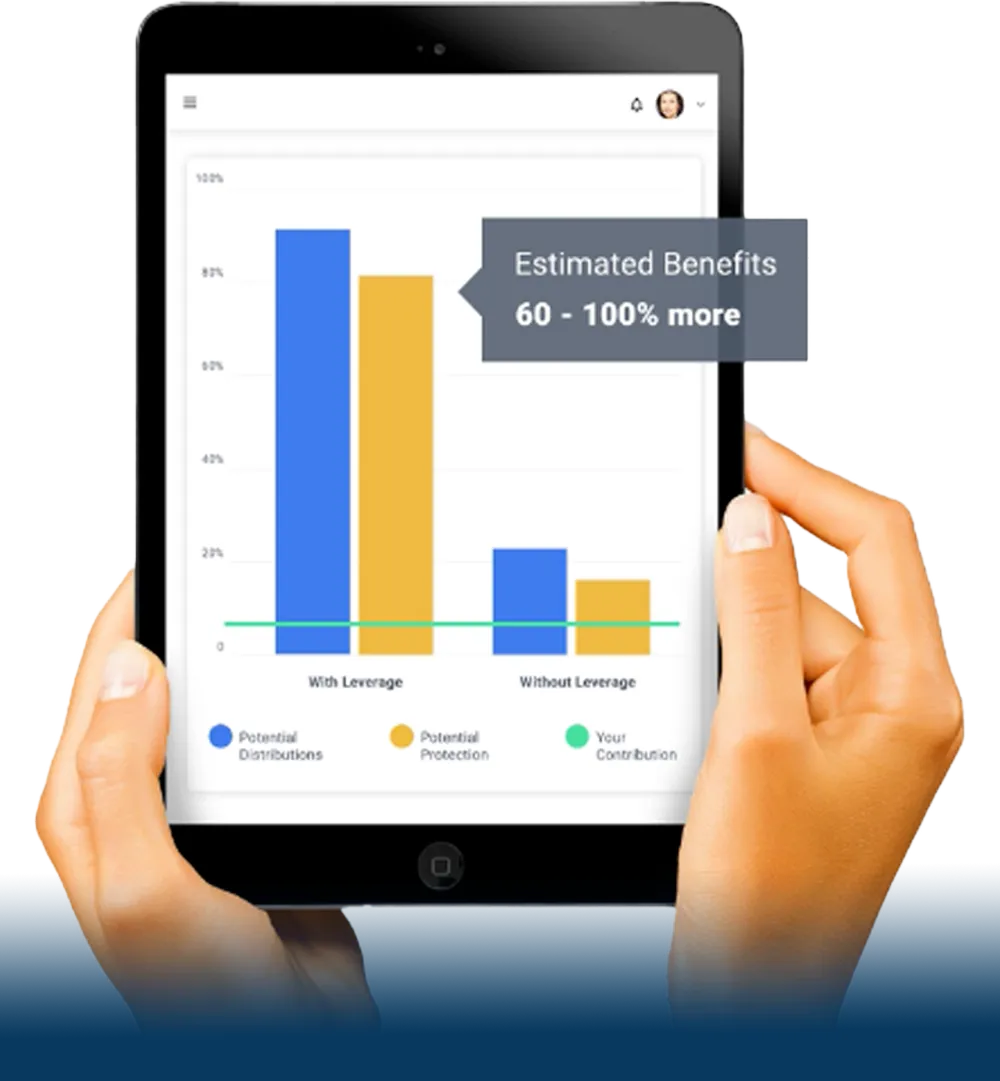

A distinctive cash-accumulating life insurance policy utilizing leverage provides an opportunity to earn interest while safeguarding against market declines, ensuring protection for you and your family. The policy secures the loan, potentially increasing your retirement savings by 60-100% without the usual risks linked to leverage.

BENEFITS OF SMART LEVERAGE

No credit checks.

No loan documents.

No personal guarantee.

No interest payments

BENEFITS OF MORE PROTECTION

Death benefit with living rider

Chronic illness

Terminal illness

Cash availability (after loan)

BENEFITS OF MORE GROWTH

Upside crediting (subject to cap)

No negative returns in the market

Tax free distributions with potential access cash value

Various conditions apply regarding the access and distribution of the cash while the bank loans are still active in the policy. See authorized Preferred Agent for details.

WHY LEVERAGE?

We’ve all used leverage to buy a better home or car.

Utilizing leverage to potentially boost growth and increase protection while maintaining your current standard of living is the intelligent way to use leverage.

WHAT CLIENTS WITH THIS PLAN SAY

“I love that the bank

is putting in 3X as

much as I am!”

- Dr. Amy Wechsler | Physician

“I was able to triple

the value of my

death benefit.”

- Steven Brown | Real Estate

“Now when I

retire I have a potential

income stream.”

- Joe Tosto | Computer Tech Sales

Leverage For Retirement

NIW and KaiZen is a registered trademark of the NIW Corp of Texas and Ray Alkalai is an authorized representative.